Real estate brokers are typically not responsible for disclosing specific hazard data related to oil and gas drilling. The disclosure of such information depends on the laws and regulations in a particular jurisdiction.

In many places, real estate brokers are required to disclose known material defects or hazards that may affect a property's value or pose a risk to potential buyers. These disclosures usually pertain to issues like structural problems, lead-based paint, or environmental hazards that are readily apparent or have been disclosed to the broker. However, the disclosure requirements may not specifically include oil and gas drilling hazards unless they fall under other categories of disclosure.

The responsibility for disclosing oil and gas drilling hazards generally lies with the property owner or seller, especially if they have knowledge of such hazards. Depending on the jurisdiction, there may be specific laws or regulations that govern the disclosure of environmental hazards, including those related to oil and gas activities. These laws often require the property owner or seller to provide information about any known risks associated with drilling activities or the presence of underground pipelines or storage tanks.

Specific regulations and disclosure requirements can vary significantly depending on the jurisdiction and local laws. If you have concerns about potential oil and gas drilling hazards when buying or selling a property, it's advisable to consult with a real estate attorney or local regulatory authorities who can provide accurate information about the disclosure requirements in your specific area.

Why don't real estate brokers disclose nearby cell towers?

Why don't real estate brokers disclose nearby oil and gas refineries?

Real estate brokers are typically not obligated to disclose nearby oil and gas refineries unless there are specific laws or regulations in their jurisdiction that require such disclosures. The disclosure requirements for real estate brokers generally focus on material defects or hazards that directly affect the property being sold, rather than external factors such as nearby industrial facilities.

However, it's important to note that disclosure laws can vary depending on the jurisdiction. Some areas may have regulations that require disclosure of certain environmental factors or hazards, including proximity to industrial facilities. In such cases, real estate brokers would be expected to comply with the relevant laws and disclose information about nearby oil and gas refineries if required.

If you have concerns about the presence of nearby oil and gas refineries when buying or selling a property, it's recommended to consult with a real estate attorney or research the specific disclosure laws in your jurisdiction. Additionally, you may consider conducting your own due diligence and research on the area to identify nearby industrial facilities that could potentially impact the property.

Why don't real estate brokers disclose nearby power plants?

Real estate brokers are generally not obligated to disclose nearby power plants unless there are specific laws or regulations in their jurisdiction that require such disclosures. The disclosure requirements for real estate brokers typically focus on material defects or hazards directly related to the property being sold, rather than external factors like nearby power plants.

The responsibility for researching and understanding the surroundings of a property often falls on the buyer or their representative. Buyers are encouraged to conduct their own due diligence and research the area they are interested in purchasing, including identifying nearby power plants or other potential sources of noise, emissions, or other factors that may affect their decision.

That said, it's worth noting that disclosure laws can vary depending on the jurisdiction. Some areas may have regulations that require the disclosure of certain environmental factors or nearby industrial facilities, including power plants. In such cases, real estate brokers would be expected to comply with the relevant laws and disclose information about nearby power plants if required.

If you have concerns about the presence of nearby power plants when buying or selling a property, it's advisable to consult with a real estate attorney or research the specific disclosure laws in your jurisdiction. Additionally, conducting your own research and due diligence on the area can provide you with a better understanding of the potential impacts of nearby power plants on the property.

How is ATTOM trying to change the real estate industry with hazard data?

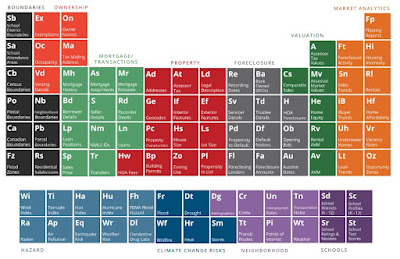

ATTOM is a provider of data and analytics solutions for businesses across various industries. ATTOM offers a wide range of innovative products and services, including delivery solutions, property data, market trends, and risk assessment tools. By combining industry expertise with advanced technologies, ATTOM empowers businesses to make informed decisions and gain a competitive edge in today's rapidly changing market.

ATTOM Data Solutions is a real estate data provider that offers a wide range of data and analytics services related to properties and neighborhoods. Here are some examples of hazard data that ATTOM Data Solutions may provide but they could do more:

Natural Hazard Risk Data: This includes information about the risk and occurrence of natural disasters such as floods, earthquakes, wildfires, hurricanes, and tornadoes. It may include historical data, risk assessments, and maps illustrating the level of risk in specific areas.

Environmental Hazard Data: This can encompass data related to environmental hazards such as soil contamination, the presence of hazardous waste sites, or proximity to industrial or toxic facilities. It may provide insight into potential risks associated with pollution or other environmental concerns.

Crime Statistics: ATTOM Data Solutions may provide crime data and statistics, including information about crime rates, types of crimes, and trends in specific neighborhoods or areas. This can be valuable for assessing the safety and security of a particular location.

Neighborhood Demographics: The company may offer data on demographics, population density, income levels, educational attainment, and other socio-economic factors that can provide a comprehensive understanding of a neighborhood's characteristics and potential risks.

Foreclosure Data: ATTOM Data Solutions is known for its foreclosure data, which can help identify properties that are in the foreclosure process or have been through foreclosure auctions. This data may include details about default notices, scheduled auctions, and bank-owned properties.

Specific hazard data provided by ATTOM Data Solutions may vary, and it's recommended to visit their website or contact them directly for the most accurate and up-to-date information on their available services and data offerings.

This is a perfect example of NAR regulatory capture

Regulatory capture refers to a situation in which government regulatory agencies, which is tasked with protecting the public interest and enforcing regulations, end up being influenced or controlled by the industry or special interest groups (NAR) it is supposed to regulate. In other words, the regulatory agency becomes "captured" by the very entities it is supposed to oversee.

This phenomenon occurs when the regulatory agency develops a close relationship with the real estate industry it regulates, often due to lobbying, campaign contributions, or other forms of influence. As a result, the agency may prioritize the interests of the industry over the broader public interest, leading to weakened or ineffective regulation.

Regulatory capture can manifest in various ways, such as:

Capture of personnel: Regulatory agencies may hire individuals from the industries they regulate or former industry insiders, leading to potential bias or conflicts of interest.

Influence over decision-making: Industry representatives may exert influence over the regulatory process by providing privileged access, information, or financial support, which can lead to favorable regulations or lax enforcement.

Revolving door phenomenon: Individuals who have worked for regulatory agencies may later find lucrative employment opportunities in the industries they were regulating, creating a conflict of interest and the perception of industry influence.

Regulatory agency capture: Regulatory agencies may develop close ties and shared interests with the industries they regulate, leading to a regulatory culture that is more sympathetic to industry concerns and less responsive to public needs.

The consequences of regulatory capture can be detrimental, as it undermines the purpose of regulation, and compromises consumer protection, public safety, and economic fairness. It can result in inadequate oversight, ineffective enforcement, and regulatory policies that primarily benefit powerful industries or special interest groups at the expense of the general public.

Efforts to mitigate regulatory capture include promoting transparency, strengthening ethics rules, establishing robust conflict of interest guidelines, and encouraging public participation in the regulatory process.

Is the real estate industry too big to turn the ship around? We will see ...